The decarbonisation software industry in the GCC region is experiencing rapid growth, driven by ambitious government initiatives and corporate commitments to sustainability. As countries like Saudi Arabia and the UAE push for carbon neutrality, the demand for digital solutions to track, manage, and reduce emissions is on the rise. From carbon accounting software to AI-powered energy efficiency tools, emerging technologies are playing a critical role in this transition.

At the same time, global players and regional startups are competing to meet the growing need for advanced decarbonisation solutions. Despite challenges such as high implementation costs and regulatory uncertainty, the opportunities for innovation and collaboration in the GCC market are vast. Let’s explore the key market drivers, technologies, and opportunities shaping the future of decarbonisation software in the region.

Key Market Drivers

- Government Initiatives: The GCC countries (UAE, Saudi Arabia, Qatar, Bahrain, Oman and Kuwait) have committed to ambitious carbon neutrality goals. National strategies like Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 target are accelerating the adoption of decarbonisation technologies.

- Corporate Sustainability Pressure: Increasing ESG regulations and corporate commitments to reducing carbon footprints are driving demand for decarbonisation solutions.

- Energy Transition: The shift from fossil fuels to renewable energy sources is creating an urgent need for monitoring, reporting, and optimization software that can aid in the transition.

Emerging Technologies

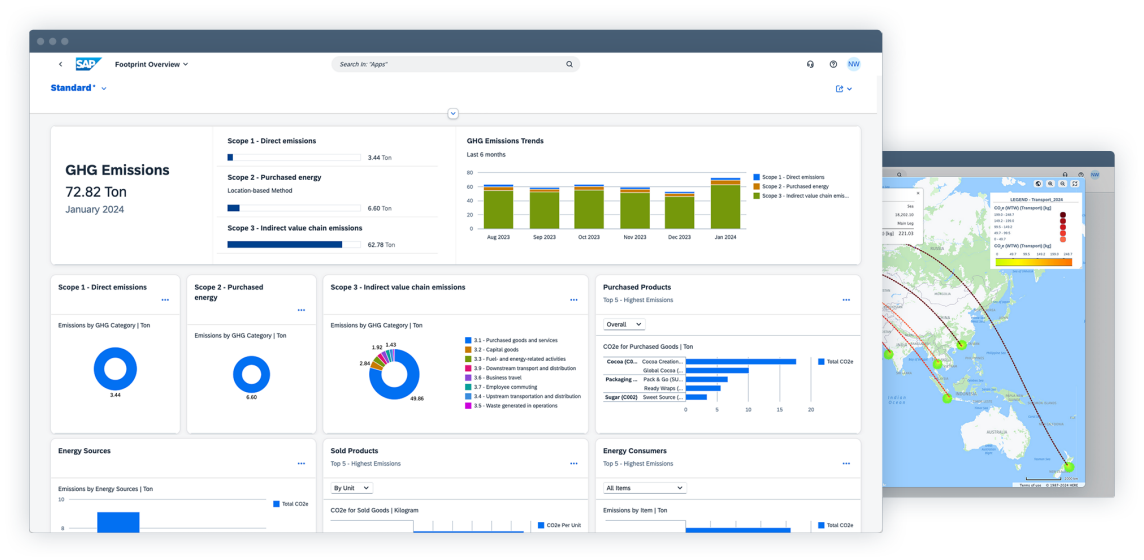

- Carbon Accounting Software: Real-time tracking of carbon emissions is becoming essential for both compliance and corporate sustainability reporting (you can learn more here).

- AI & Machine Learning: Predictive analytics tools for carbon footprint management and energy efficiency optimisation are gaining traction.

- Blockchain: Distributed ledger technology is emerging to ensure transparency in carbon trading and tracking renewable energy credits.

- IoT Integration: Smart sensors and IoT devices are enabling real-time emissions monitoring and environmental impact tracking across industrial processes.

Regional Landscape

- Saudi Arabia: Leading the region with major investments in decarbonisation, including the Neom smart city project. Growing interest in carbon capture and storage (CCS) technology.

- UAE: A frontrunner in sustainability efforts with a focus on renewable energy integration, especially solar. Strong interest in digital solutions to meet Net Zero 2050 goals. The UAE are the first country in the Middle East and North Africa region committing to carbon neutrality.

Competitive Analysis

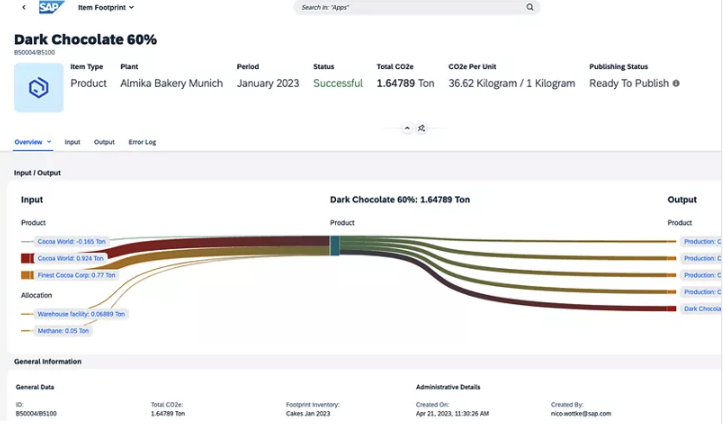

- Global Players: International companies like Microsoft, IBM, and Schneider Electric are entering the GCC market, offering advanced decarbonisation software solutions. SAP should follow rapidly with their corporate and product carbon footprint calculator embedded in their ERP

- Regional Startups: Local startups such as Quant and ClimateView are gaining market share with innovative solutions tailored to the specific needs of the GCC.

- Consulting Giants: Companies like PwC and EY are integrating decarbonisation software into broader sustainability consulting services, targeting large corporations and governments.

Challenges and Opportunities

Challenges

- High Initial Costs: The adoption of advanced decarbonisation software can be capital-intensive, creating barriers for small and medium enterprises (SMEs).

- Data Infrastructure: Inconsistent and insufficient data collection on emissions can hinder the effectiveness of decarbonisation tools.

- Regulatory Uncertainty: While sustainability regulations are evolving, inconsistent implementation across the region creates compliance challenges.

Opportunities

- Partnerships: Collaborations between software providers and industrial sectors (oil & gas, construction) can drive widespread adoption.

- Renewable Energy Projects: The surge in solar and wind energy projects offers a growing market for software that optimises renewable energy usage.

- Government Support: GCC governments are offering incentives and subsidies to promote the adoption of decarbonisation technology, creating opportunities for market expansion.

This memo outlines the key drivers, emerging trends, and opportunities within the growing decarbonisation software market in the GCC. The region is poised for rapid growth as sustainability becomes a top priority across both public and private sectors.

FAQs About the Decarbonisation Software Industry in the GCC

What challenges does the decarbonisation software industry face in the GCC?

Key challenges include High Implementation Costs as the expense of deploying advanced decarbonisation technologies can be substantial and Regulatory Uncertainty. Evolving policies may create complexities for businesses aiming to comply with new standards.

What opportunities exist for the decarbonisation software industry in the GCC?

Innovation and Collaboration with the growing demand for decarbonisation solutions that fosters an environment ripe for innovation and partnerships and Market Expansion as sustainability becomes a priority, there’s potential for substantial growth in decarbonisation software adoption across various sectors.

What is driving the growth of the decarbonisation software industry in the GCC?

Several key factors are propelling this growth:

- Government Initiatives: GCC nations, including Saudi Arabia and the UAE, have set ambitious carbon neutrality targets, such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 strategy.

- Corporate Sustainability Efforts: Companies are increasingly adopting Environmental, Social, and Governance (ESG) standards, necessitating tools for effective carbon footprint management.

- Energy Transition: The shift from fossil fuels to renewable energy sources requires sophisticated software to monitor and optimise energy usage.